The surgical robotics adoption problem

Why robot surgery is used in only 3% of all surgeries, and how it can move beyond this

This is the second article in a series about surgical robotics. Please find the first article introducing the topic here.

TL;DR

The high volume and value of surgical robotics transactions (M&A, IPO, fundraising) suggests surgical robotics adoption will continue to grow

Although surgical robotics works and is safe, there is uncertainty whether it delivers clear benefits compared to traditional surgical methods

Cost and utilisation are major issues holding surgical robotics back (e.g. robotic systems alone can cost >USD1m per unit)

Continued innovations in shrinking the size of surgical robots, single-port surgery, standardisation of surgical robot training for surgeons and growing important of software and AI are potentially major drivers of greater surgical robotics adoption

Boom.

First off, I cobbled together some information which could strongly indicate why surgical robotics adoption looks set to grow. Just look at the number of transactions since 2015:

The most interesting part? The USD billions in transaction value (both funds raised and acquisitions), much of which has been driven by large medtech companies acquiring surgical robotics tech companies.

Patients are seeking shorter recovery times, less scarring from surgery. As importantly, surgeons want career-extending assistance offered by surgical robot technology to make their results more consistent.

The big boys in the market understand this very well, which is why they have invested and acquired to capture the innovations they might not have been able to create themselves.

In China, the sheer number of IPOs and mammoth funding rounds suggest a major intent to create companies that will one day become surgical robot champions.

This isn’t even a full list of all the transactions, notably excluding transactions to do with tech that enable surgical robotics (e.g. surgical vision, guidance, haptic feedback, planning, training etc.).

At the prospect of future consolidations through further M&A, investment bankers will be salivating,

Again, only 3% of surgical procedures are said to involve surgical robotics. So what is holding it back? Most importantly, why will it change the face of surgery?

Read on!

Robotic surgeries don’t always deliver better outcomes

“Yes, robotic is safe, we’ve proven that. But we haven’t proven it’s better”

— Dr. Naila H. Dhanani, a surgical resident at UT Health in Houston

There is in fact a big and ongoing debate about whether robotic surgeries deliver any real benefits at all. One the one hand, a study by University College London found clear benefits of robotic surgery in bladder cancer patients. On average, the robot-assisted group stayed eight days in the hospital, compared to 10 days for the open surgery group – a 20% reduction. Readmittance to the hospital within 90 days of surgery was also significantly reduced – 21% for the robot-assisted group v.s. 32% for open surgery.

In other studies, urologic and gynaecologic robot surgeries had similar rates of needing to be switched to open surgeries because they failed to work, and mortality rates were not really any different across the open, laparoscopic and robot techniques. They also found robot surgeries consistently took longer to perform than other forms. This isn’t helpful if robotic surgeries are to become more widely adopted.

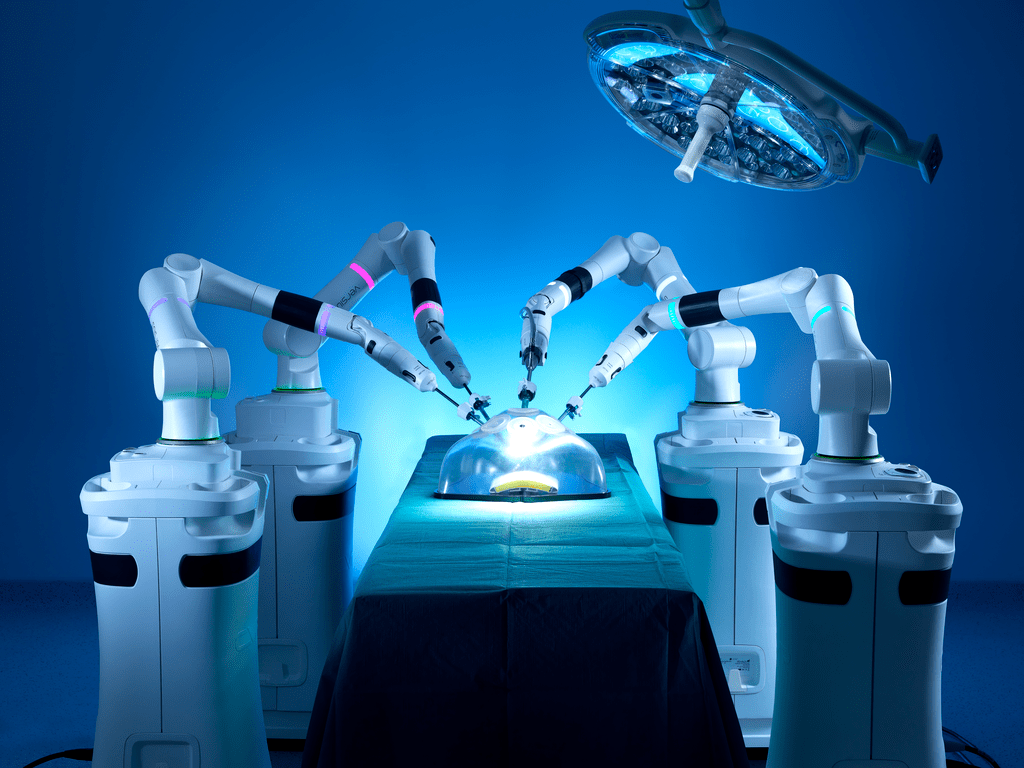

Robot-assisted surgery has really come a long way to reach the mainstream, but there is great potential for further improvements.

Cost and utilisation

These considerable costs need to be absorbed somehow by medical institutions, insurers and patients, and the issue of system utilisation by hospitals crops up

Intuitive Surgical’s well-proven razor/blade approach means customers are charged like this:

Robotic systems: USD500k-USD2m

Surgical procedure costs of USD750-3,500

Service contracts to repair, maintain and support customers of USD80k-USD190k per year

Clearly, these huge costs need to somehow be absorbed by medical institutions, insurers and patients. This is also why the issue of system utilisation by hospitals has cropped up, which varies procedure by procedure, country by country.

For example, in the US cholecystectomy (gallbladder removal) using robots is more cost-sensitive due to its lower reimbursement rate, since healthcare system reimbursement codes only exist for open and laparoscopic procedures, and may be up to 14% more expensive versus laparoscopies. It is also one of the safest and most laparoscopic procedures, and this means it is well-suited to robotic procedures (which many surgeons use to train for robotic surgery), but also harder to charge a robot premium for. In Japan on the other hand, prostatectomies (removal of the prostate) and nephrectomies (removal of the kidney) using robotic systems are reimbursed at higher rates than non-robotic procedures, which means robotic surgery is the mainstay for such procedures over there.1

In China the utilisation rate has generally been much higher given the government’s quota system (Da Vinci has had much higher utilisation rates there compared to their US home market).

The topic of reimbursements in healthcare is an interesting but complex topic, and something that could be explored further in another analysis. Reimbursement risk seems to be one of the most important concerns of medtech investors these days — have a listen to this podcast by a panel of medtech VCs.

Supply chain complexity

In their earnings call for Q2 2022, ISRG mentioned how the semiconductor shortage was delaying and impacting their customer deliveries and installations. As it happens, not only do surgical robot companies have a vast supply chain network for components in their robots, this is also the case for consumables such as surgical tools. These surgical tools are also becoming ever more sophisticated and connected (for example, ISRG has custom computer chips in their tools which drive how they should interact with other surgical tools, and prevent them from being used more than the prescribed number of procedures). Take a look at their EndoWrist line of products and you will see the amount of tech that has gone into these finite-use surgical tools, and how a collection of different tool heads for resection, ligation and cauterisation means any potential disruption to the supply chain needs to be carefully prepared for.

Space constraints in the operating theatre

With the trend of surgeries being performed at smaller, ambulatory surgery centres outside of hospital settings, this becomes a challenge

Real estate around the operating table is limited. Apart from surgeons directly operating on the patient there may be other observers in the room crowding around the patient, and surgical robotics have historically been large, cumbersome devices occupying significant space. In a hospital setting this can be tolerated, however with the trend of surgeries being performed at smaller, ambulatory surgery centres outside of hospital settings (especially in the US), this becomes a challenge. Large Da Vinci systems with their bulky arms, and three large functional carts, are difficult and too expensive to use.

To solve this, surgical robots are becoming ever smaller, portable and modularised.

As an example, with individual robotic wristed-arms, CMR’s Versius system and console unit with joystick controls allows the surgeon to stand next to it for it to be operated, and allows for smaller surgical tools to create smaller incisions. Surgeons at UKSH University Hospital of Schleswig-Holstein in Kiel, Germany, were able to use the Versius system to perform robotic reconstructive procedures, such as intracorporeal suturing (making stitches within the body) and knot-tying, in cavities as small as 106 mL. If you don't think this is that small, consider all the tools need to be manoeuvred through a space the size of a small jam jar -- it's an impressive feat.

Taking the miniaturisation game to an extreme, there is also a trend towards developing surgical microrobots. These robots are no larger than 100s of μm (micrometres) — the width of a few strands of human hair. ETH Zurich has been developing an application for invasive eye surgery based on piezoelectric micromotors propelling the microrobots through the bloodstream by an external magnetic field.

The future seems set for surgical robots of different sizes and applications.

Single-port laparoscopy and natural orifice surgery

One really interesting trend has been single-port laparoscopy, a minimally-invasive surgery performed through a single, very small incision point (around 11mm or 20mm) aiming to further reduce scarring and trauma -- a recent surgical development which began clinical use in September 2018.

An endoscope and other surgical tools are positioned through somewhere in the abdomen such as the belly button, allowing the surgeon to get their job done only through a single opening. Amazing. It is now performed in kidney, gallbladder, and several other soft tissue surgeries. That said, the jury is still out on whether or not single-port is truly advantageous right now, because there have been concerns about limitations on movement within the surgical site (instrument and camera clash is common), and doubts about whether trauma is reduced for the patient.

Another cool application is surgery through the body’s natural orifices (e.g. mouth, urethra, anus, other private parts…) or making incisions within the body which will avoid leaving any external scarring. This advanced form of minimally-invasive surgery is often called natural orifice transluminal endoscopic surgery (NOTES). At the moment, only Momentis’s (FKA Memic) Anovo™ robotic system has FDA-approval to conduct such surgeries, being an emerging and highly technical procedure.

Standardisation of surgical robotics training and approaches

Surgeons calling tech support mid-robotic surgery? Not a joke – it really has happened! With so many different surgical robotics solutions, there remains a lack of national consensus on how to train surgeons to use surgical robots, often leaving surgeons with their hands full trying to adapt.

Apart from the lack of haptic feedback that surgeons are used to, robotic surgical workflows can differ significantly from traditional surgery, and these are sometimes not formally taught, particularly with robot setup and calibration, robot-assisted interventions and computer-aided assessments. They also require much more collaboration between team members (think of the extra coordination required between robotic scrub, nursing and surgical personnel).

Companies such as Explorer Surgical (now part of GHX), Osso VR, and Touch Surgery (now part of Medtronic) are offering digital training playbooks and immersive virtual training solutions to surgeons in order to get practitioners rapidly up to speed, turning in-person robotic surgical experiences into "last-mile training" as opposed to using them for initial training experiences.

Software and Artificial Intelligence

In fact, the growing emphasis on software and artificial intelligence in surgical robotics is enabling a whole new range of capabilities.

For example, Asensus Surgical rolled out their Intelligent Surgical Unit (ISU) which was FDA 510(k) approved in March 2020 for use with their Senhance surgical robot.

The ISU works with any off-the-shelf vision systems and covers pre-op intelligent preparation, real-time guidance during the operation, and performance assessment post-op. During the operation in particular, the ISU overlays useful insights such as tool positioning, and tissue measurements to the surgeon in real-time thanks to being powered by two NVIDIA Quadro RTX 6000 graphics cards acting as the backbone of their image processing capability.

During their September 2022 keynote, NVIDIA went further on their commitment on medical grade AI chips, showcasing an expanding ecosystem of European surgical tech upstarts such as Proximie and Moon Surgical which are using their NVIDIA IGX and NVIDIA Clara Holoscan platforms to build their surgical AI capabilities.

NVIDIA’s keynotes are always fun to watch, and my personal highlight was seeing NVIDIA CEO Jensen Huang “beam in” at the start.

So, a bit of a laundry list of the key topics in surgical robotics these days. And as you’ve seen, there are plenty of interesting things happening in the space, but we still have a few humps to overcome, especially around economics and proving the benefits far exceed traditional surgery, to accelerate adoption.

In the next article, I’ll be introducing a company that has rethought how surgical robotics should be approached, hitting these challenges head-on.

Was this article on surgical robotics adoption useful? Help me to improve!

With your feedback, we can improve the letter. Click on a link to vote:

Build your own? 👉 FeedLetter.co

All views contained in this article are my own and do not necessarily represent the views of any other organisation.

None of the above constitutes investment advice in any way.

Robotic cholecystectomy adoption:

Citi: Intuitive Surgical broker report 1-Apr-21, Journal of the American College of Surgeons 2017